In May 2015 I had briefly visited the Williams Vix Fix (WVF) when I was ‘Rethinking indicators’. On and off since then I had explored various setups on the WVF. Like most things in trading the importance of some aspect doesn’t quite hit you until later on. In the last few weeks I had been backtesting the WVF and came up with some conclusions that it is a workable strategy for delivering overall profits.

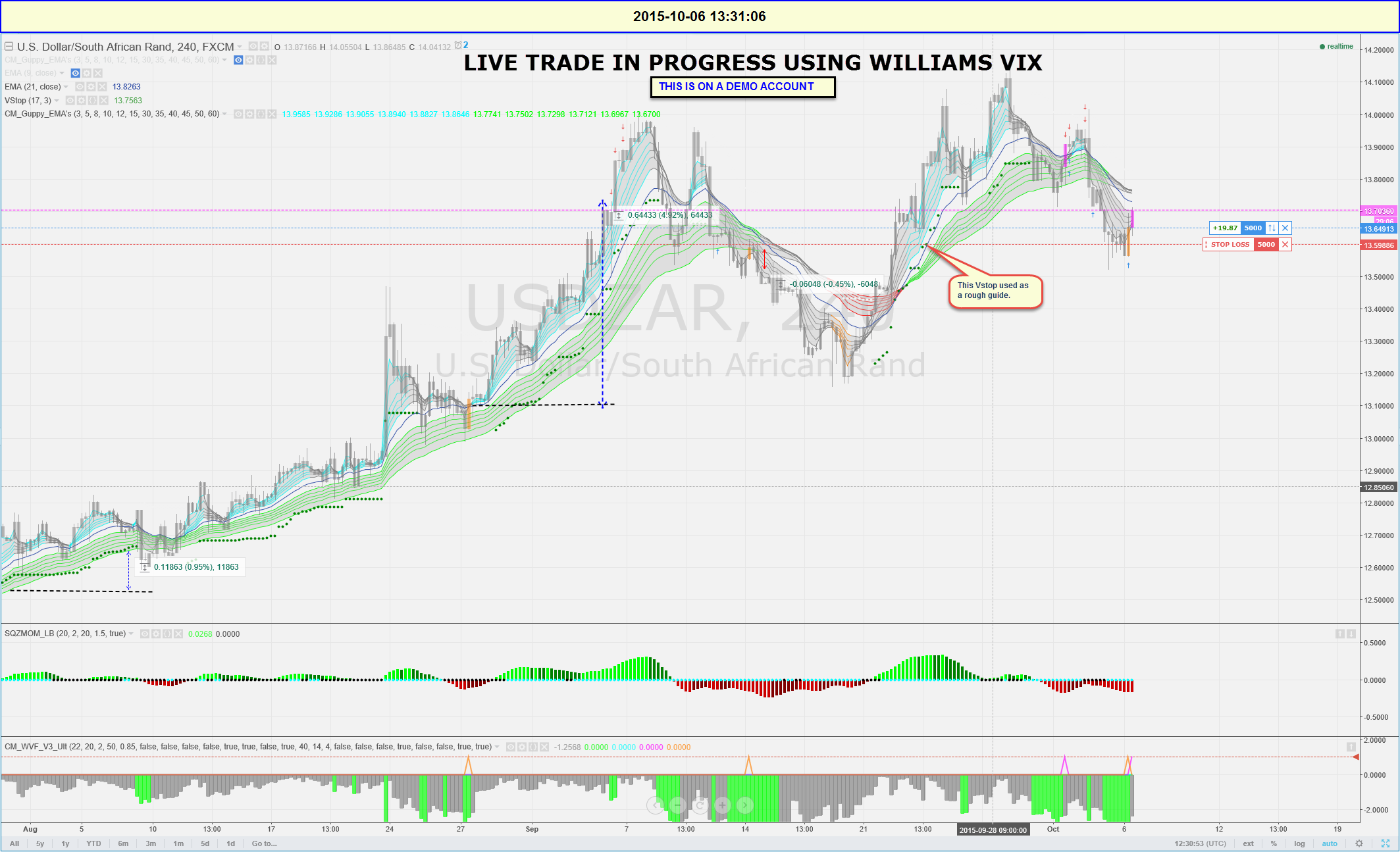

In the first two charts below I show live demo account trades. AUDUSD stops have been moved up using the Vstop indicator to a no-loss position. Chris Moody referred to the Vstop in his training video on the WVF, and how it is used with the WVF.

Success or failure of individual live trades below does not prove or disprove the strategy. The strategy is proved successful if individual traders can manage their stop-losses successfully to minimise losses on losing trades but also moving stops up to follow very large trends on winning trades. Demo accounts are very useful for gaining experience and confidence in this strategy. The mathematics shows that it can be profitable if played correctly. However it is skill and experience that will bring in overall profits.

Very new traders should not become too scared by all the lines etc. Most of them are not necessary to a WVF trade. The important things to focus on are ‘entry signals‘ created by the WVF and how the Vstops work to trail the stop-loss up. See also points gained v points lost. This system takes emotion out of the equation. It is quite mechanical.

AUDUSD

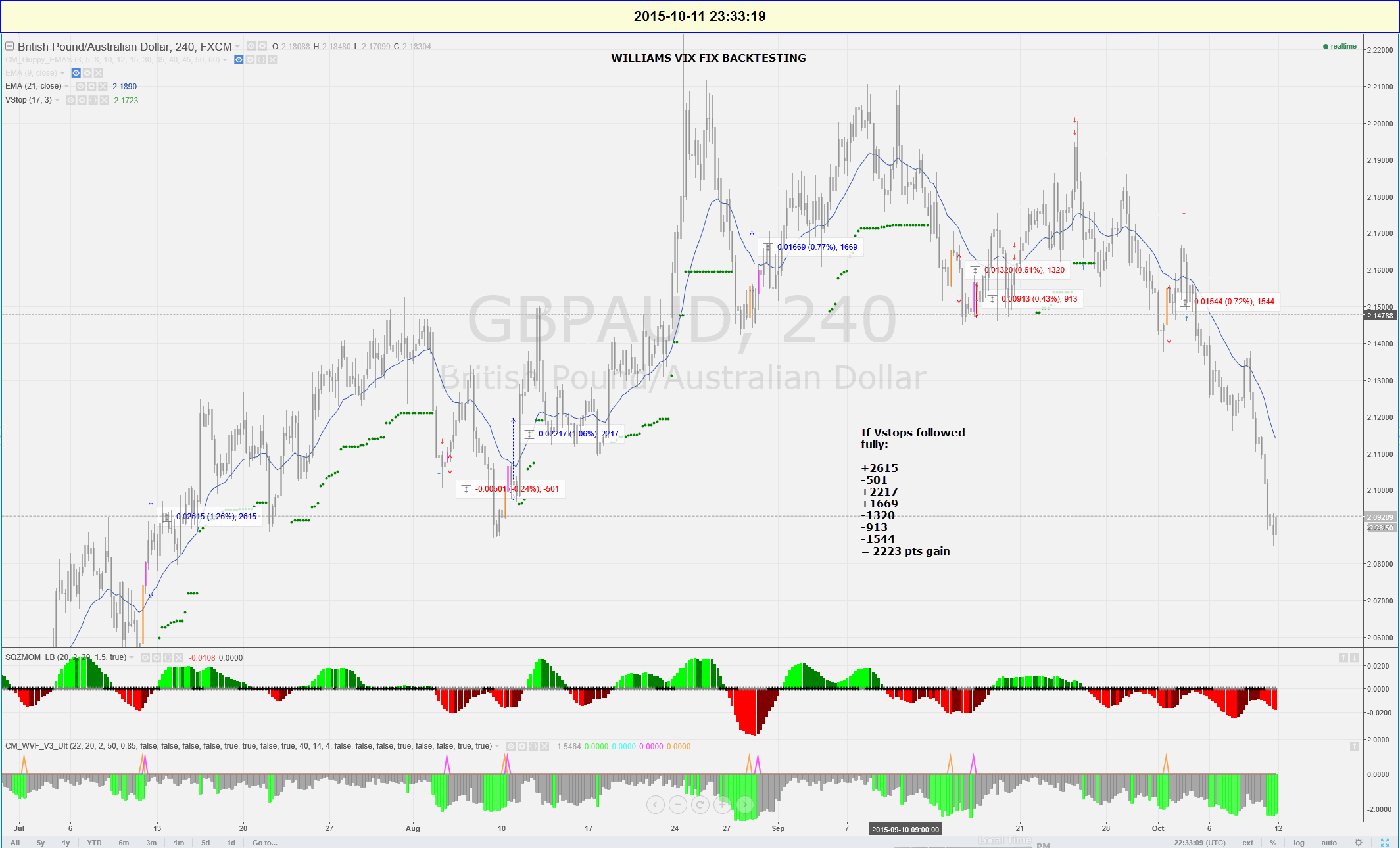

The following other annotated charts show the gains relative to losses might work. I have done similar testing with other currency pairs on different time frames. The following backtesting and forward testing, in some instances were done following the date of this post.

Overall I’ve concluded for the moment that the WVF is most efficient on 4 hourly charts and on markets that are either ranging or moving with slight overall upward or downward trends on time frames higher than 4 hourly.

Leave a Reply

You must be logged in to post a comment.